coinbase pro taxes missing

Without the original purchase transaction data from Coinbase the users true 10000 cost basis in his 05 BTC will be missing. And update your coinbase csv parser codebase while your at it to support coinbase recently modified formatting.

The Coinbase Conundrum Providing Accurate Tax Information To Users By Lucas Wyland Hackernoon Com Medium

It looks like Kraken is missing as well.

. It looks like this 05 BTC just magically appeared in the users Gemini wallet. If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K instead of the 1099-Misc. You should only trust verified Coinbase.

You should only trust verified Coinbase. Please assess the issue rather than pointing your users to to documentations that no longer solves the issue. Coinbases 1099K form is a kind of consolidated information describing the volume of your trades Exchanges like Coinbase provide transaction history to every customer but only customers meeting certain mandated thresholds will also receive an IRS Form 1099-K.

Youll need to enter a Destination address and ID Tag Destination TagMemo. Go to Withdraw Select Currency Type. For individuals in the following states the threshold for receiving a 1099-K is much lower.

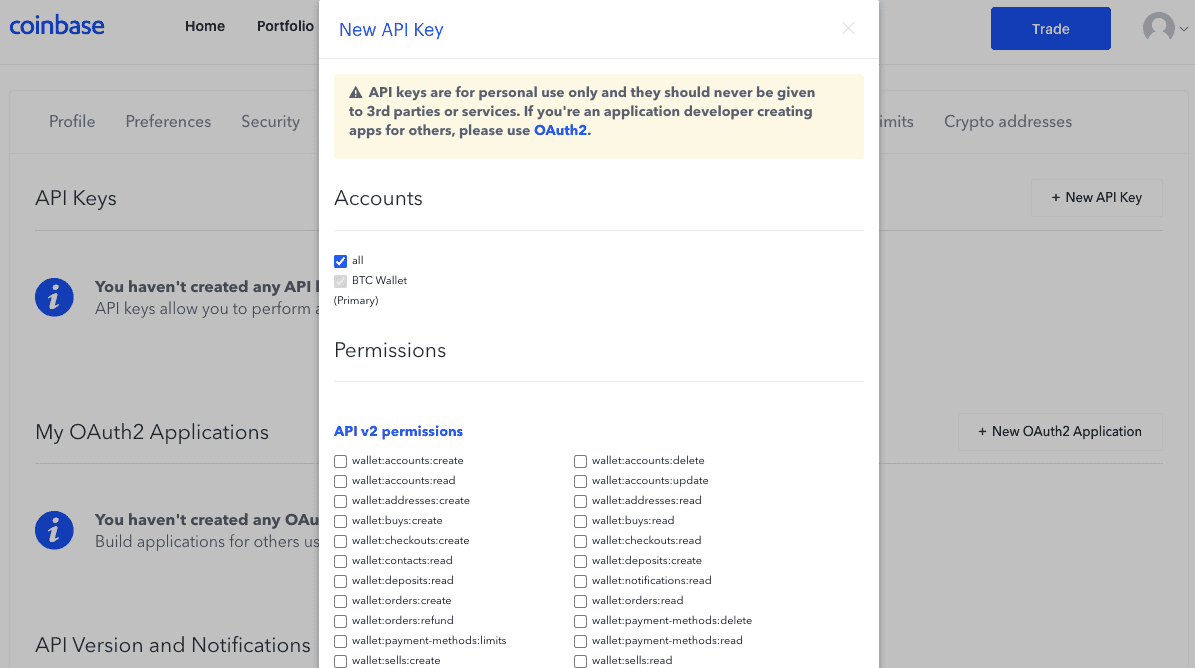

Via the Pro API. I reconnected the Coinbase Pro exchange using a new API key and let it sync. So will customers on those platforms who meet lower thresholds in AR DC MA MS MO.

The features of directly importing transactional information from brokerages ie robinhood or crypto-exchanges ie coinbase is the main. Still doesnt show GNT and XRP transactions. CoinTracker is free for Coinbase and Coinbase Pro customers for up to 3000 transactions.

For your security do not post personal information to a public forum including your Coinbase account email. Clarifying the 1099K Tax Form From Coinbase Pro For Crypto Investors. Youll only be allowed to use addresses already.

Our tax software can even generate pre-filled tax reports based on your location and your tax office - for example a pre-filled IRS Form 8949 and Schedule D. Just use the Coinbase tax API or a Coinbase transaction history export and upload it to your crypto tax app where it will then generate a custom Coinbase tax form on your behalf. To withdraw from Coinbase.

Its tax season once again in the United States and that means its time to take out our calculators load up the tax software or pay a visit to a certified public accountant to make sure all income gains and losses are properly reported to the Internal Revenue Service. Users can withdraw to whitelisted address using full crypto address. Support for FIX API and REST API.

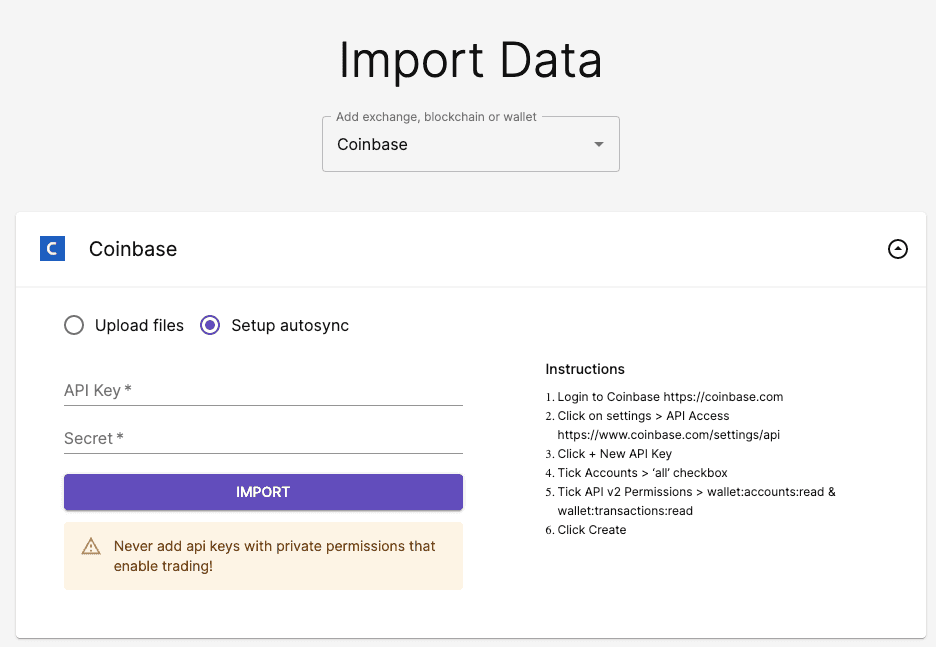

Bitcointax really seems to have gone downhill over the years. However this year Im trying to import Coinbase Pro trades and Coinbase Pro is completely missing from the Import Income options. Import your transaction history directly into CoinLedger by mapping the data into the preferred CSV file format.

Only some segments of Coinbase users receive paperwork from Coinbase during tax season. Its been there in previous years. These features are only available for Coinbase Pro users.

Coinbase and Coinbase Pro customers have free access to tax reports for up to 3000 transactions made on these platforms and get 10 off CoinTracker plans that support the syncing of any other Wallet or exchange. Even though you could have just traded with 10K it will have all the buys. Crypto mined as a business is taxed as self-employment income.

Staking rewards are treated like mining proceeds. CoinLedger automatically generates your gains losses and income tax reports based on this data. Coinbase Pro Prime and Merchant customers who meet a threshold of more than 20000 in gross proceeds and 200 transactions in 2018 will receive an IRS Form 1099-K.

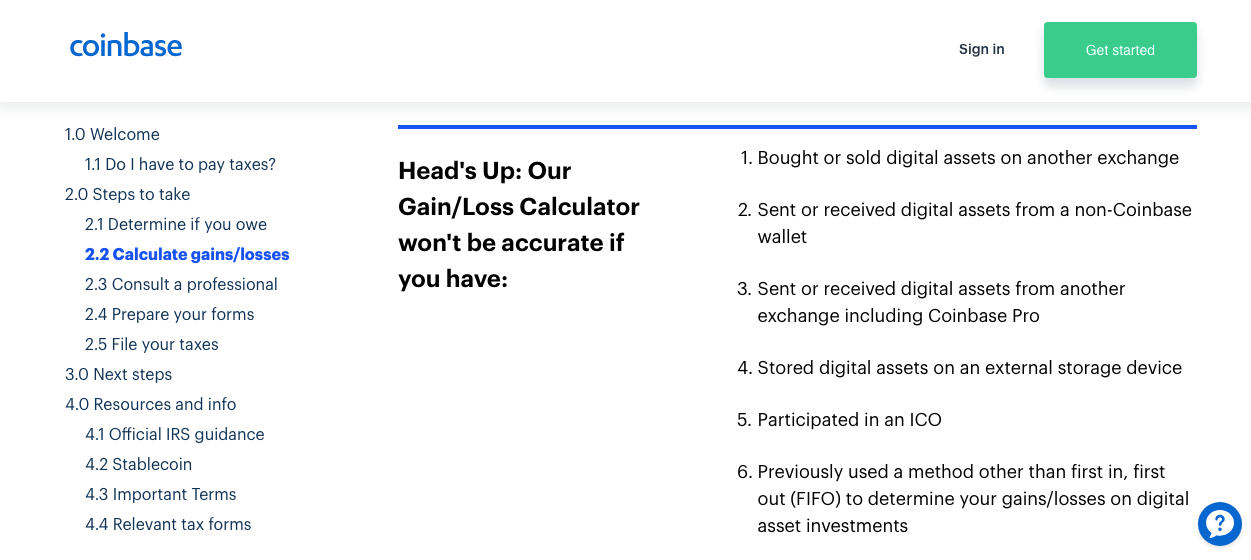

There are some cases where Coinbase is missing this information eg. If you used Coinbase Pro Coinbase Wallet or other platforms you may need to aggregate all your activity with an aggregator like CoinTracker to prepare to file your taxes. Missing Your tax information is currently missing.

There will be a QR code for address and one for tag which you can switch using a toggle. If you have a case number for your support request please respond to this message with that case number. If youre experiencing an issue with your Coinbase account please contact us directly.

As I mentioned earlier Im not able to even added them manually as it doesnt show a Coinbase Pro GNT wallet. If you have a case number for your support request please respond to this message with that case number. Coinbase Tax Resource Center.

Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP. Navigate to your Coinbase Pro account and find the option for downloading your complete transaction history. The customer received it from an external wallet.

How do you import Coinbase Pro trades. Taxes are based on the fair. Easily deposit funds via Coinbase bank transfer wire transfer or cryptocurrency wallet.

Can you at least allow the functionality to add the transactions manually. This would trigger a Missing Cost Basis Warning as the user has not shown CryptoTraderTax how he originally acquired that 05 BTC. For your security do not post personal information to a public forum including your Coinbase account email.

Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received. Coinbase Pro - Taxes Status.

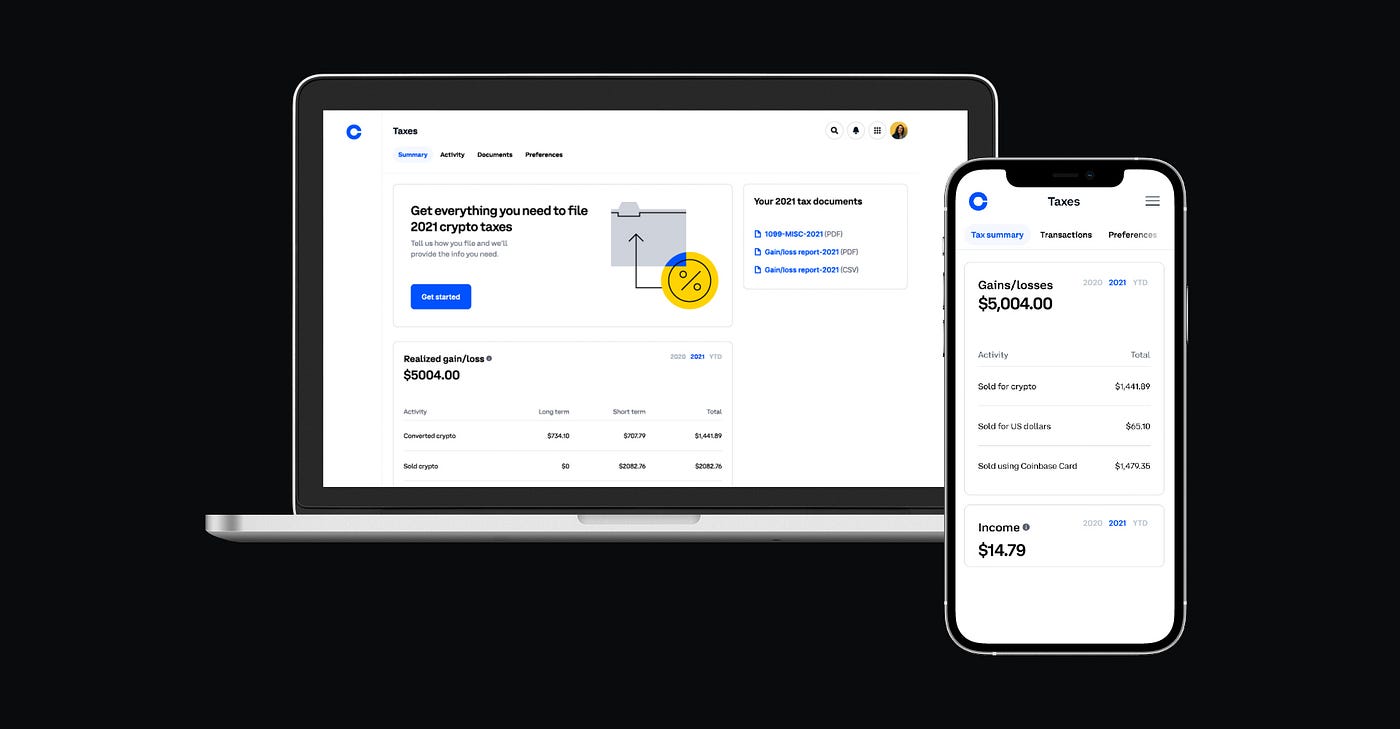

I just looked today on Coinbase Pro and there is a new tab under my profile that says Taxes and then under that heading it says. Editing can only be done via desktop however the Address Book can still be viewed on mobile devices. This information must be provided by December 31 2019.

Use the deposit QR codes to access the address and TagMemo. What About Coinbase Pro Tax Documents. If youre experiencing an issue with your Coinbase account please contact us directly.

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Coinbase Pro Taxes Status Missing R Bitcointaxes

![]()

Using Turbotax Or Cointracker To Report On Cryptocurrency Coinbase Help

Coinbase Pro Tax Reporting How To Get Csv Files From Coinbase Pro Youtube

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Pro Taxes Status Missing R Bitcointaxes

The Ultimate Coinbase Pro Taxes Guide Koinly

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Tax Documents To File Your Coinbase Taxes Zenledger

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Beware Coinbase Caused Me To Be Audited By The Irs And A Lien Garnished Wages Imposed For Income I Didn T Make R Bitcoin

/Coinbase_Recirc-491954284dee4e9eb1ed773c3eb3a71f.jpg)